California Private Student Loan Debt Attorney

Helping Clients Navigate Private Student Loan Debt Challenges in Santa Ana

If you have ever searched for "student loan lawyers near me," trust Fitzgerald & Campbell, APLC, to assist you with your Private Student Loans on a No Settlement = No Fee basis (pre-litigation cases only). Handling these complex loans demands seasoned legal expertise, and we are here to help you navigate the challenges. Contact our experienced student debt attorneys today to secure the professional assistance you require.

Please note that we currently do not provide assistance with Federal Student Loans due to the constantly changing law and the uncertainty surrounding government actions. When circumstances change, we will reconsider assisting with Federal student loans.

Don't let private student loan debt overwhelm your life. Call Fitzgerald & Campbell, APLC, today at (844) 431-3851 or contact us online to explore your options and take the first step toward financial relief!

Understanding Student Loans and Their Impact

Student loans are a form of financial aid offered to students to help cover higher education costs, including tuition, books, living expenses, and other educational fees. These loans are designed to assist students who might not have the immediate means to pay for their education.

There are typically two types of student loans: federal and private.

- The government provides federal student loans. They often have fixed interest rates and more flexible repayment plans. Due to lower interest rates and various repayment options, they're usually the preferred choice.

- Banks, credit unions, or other financial institutions offer private student loans. These loans might have variable interest rates and usually require a credit check. They might offer less repayment flexibility and typically have higher interest rates than federal loans.

Student loans must be paid back with interest after a student graduates, leaves school, or drops below a half-time enrollment status. Repayment terms, interest rates, and grace periods can vary depending on the type of loan and the terms agreed upon during the application process.

One critical aspect of student loans is that they can significantly impact a person's financial situation for years after graduation. If not managed properly, they can lead to financial strain. However, they can also be valuable for investing in education and career prospects.

Key Factors Contributing to Student Loan Debt

Here are several factors that contribute to the accumulation of student loan debt:

- Rising Tuition Costs: One of the primary contributors to increasing student loan debt is the rising cost of tuition at colleges and universities. As educational institutions raise their fees, students often need to borrow more to cover these expenses.

- Room and Board Expenses: In addition to tuition, housing, meals, and other living expenses at college can significantly increase the overall debt burden.

- Interest Accrual: Student loans typically accrue interest over time. This means that borrowers repay more than the initial borrowed amount. The interest rates can vary based on the type of loan and its terms.

- Loan Terms and Repayment Plans: The terms and repayment plans chosen during the loan application process can impact the total amount owed. Longer repayment periods might lead to lower monthly payments but can increase overall interest costs.

- Limited Financial Aid and Scholarships: Insufficient financial aid and scholarships can lead students to rely more on loans to cover their educational expenses.

- Economic Factors: Economic conditions can impact a family's ability to contribute to educational costs, leading students to seek more significant loans.

- Pursuit of Higher Education: Pursuing advanced degrees or longer educational programs often results in higher student loan debt levels than shorter programs.

- Lack of Financial Literacy: Sometimes, students and their families might not fully understand the implications of taking on student loans, leading to borrowing more than necessary or not fully comprehending repayment terms.

- Limited Part-Time Work Opportunities: Balancing work and studies can be challenging, and limited opportunities for part-time work might lead students to rely solely on loans to cover expenses.

- Expenses Beyond Tuition: The overall amount borrowed is contributed by costs associated with textbooks, supplies, transportation, and other educational necessities.

Legal Protections Against Unfair Lending Practices

Private student loan borrowers are protected from unethical and unlawful behavior by lenders and debt collectors under laws such as the Fair Debt Collection Practices Act (FDCPA). These protections are critical when facing aggressive collection tactics or deceptive practices. Partnering with a knowledgeable student loan attorney ensures your rights are upheld, and lenders are held accountable for violations. Critical legal protections include:

- Protection Against Harassment: Prevent lenders and collectors from using abusive language or contacting you excessively.

- Prohibition of Deceptive Practices: Protect yourself from misleading information about your loan or repayment options.

- Enforcement of Fair Practices: Ensure accurate reporting of loan details and compliance with contractual obligations.

- Representation in Disputes: Have legal support when disputing unauthorized charges or errors in your loan account.

- Guidance on Legal Recourse: Understand your options if lenders violate your rights, including potential claims or lawsuits.

Why Hire a Private Student Loan Debt Lawyer from Fitzgerald & Campbell?

Rest assured, there are viable solutions for Private Student Loans. Do not fall prey to lenders' fearmongering tactics or the misleading promises of "student loan assistance companies." Resolving these matters is not as simple as filling out a form.

Consult experienced student debt lawyers who are well-versed in handling intricate financial burdens to attain the clarity, confidence, and control you need.

Here are just some of the many reasons to hire a private student loan debt lawyer from Fitzgerald & Campbell:

- Expert guidance in navigating complex loan structures

- Protection against aggressive lenders and collectors

- Knowledge of changing student loan laws and regulations

- Potential for debt reduction, settlements, or dismissals

- Peace of mind and confidence in resolving student loan debt

Contact our experienced California private student loan debt attorneys for a personalized plan to tackle your financial challenges. Schedule your consultation now!

Featured Case Results:

- March 20, 2025: Client Saved $103,349.00! From a $147,641.00 Velocity Investments, LLC debt, that was settled for $44,292.00.

- March 12, 2025: Client’s debt was reduced by $19,916.00! From a judgment against our client in the amount of $34,916.00 that was settled for $15,000.00! After our attorney fees and costs of $3,960.00, client’s net savings amount was at least $15,956.00 (National Collegiate Student Loan Trust vs. Client Case # 34-2015-001765XX-CL-CL-GDS – Sacramento County)

- February 20, 2025: Client Saved $10,432.00! From a $15,432.00 Navient Solutions, LLC debt, that was settled for $5,000.00.

- January 28, 2025: Client Saved $32,900.00! From a $47,000.00 Sallie Mae debt, that was settled for $14,100.00.

- January 24, 2025: Client Saved $26,555.00! From a $40,660.00 Sallie Mae debt, that was settled for $14,105.00.

See more results here.

Fitzgerald & Campbell, APLC Saves Hundreds of Thousands on Private Student Loan

by Sam Miller

August 21, 2018

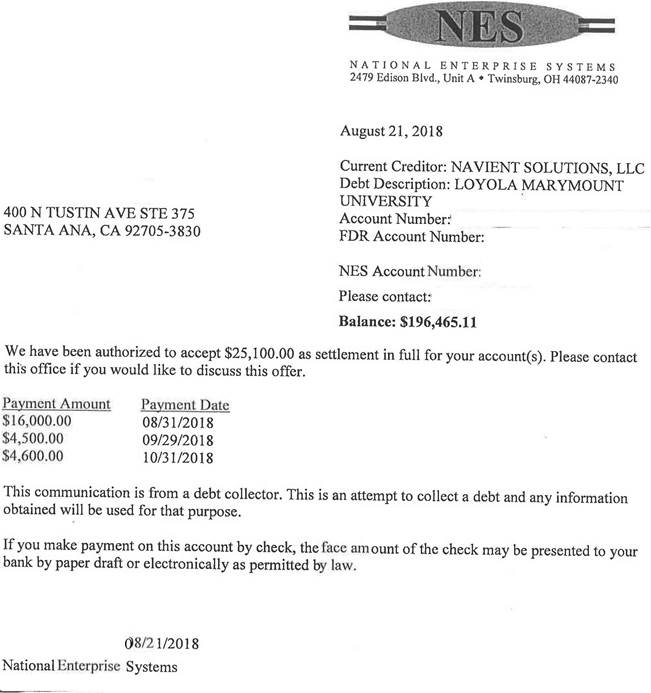

Fitzgerald & Campbell, APLC negotiated a private student loan debt totaling nearly $200,000.00 for a mere $25,100.00 this past week, saving their client over 87% of the amount due.

The debt originated with Navient Solutions, LLC, and had been placed into collections with National Enterprise Systems (commonly known as NES). The alleged amount stood at $196,465.11 at the time of settlement.

The letter from NES confirming the terms of the settlement is displayed below. Fitzgerald & Campbell, APLC are proud to continue their pattern of excellent service and phenomenal deals for their clients, and this is a shining example.

DISCLAIMER: Every case is different. Results depend on the unique law and facts of each case. Fitzgerald & Campbell, APLC makes no guarantees or warranties about the outcome of any particular matter or case. The Fitzgerald & Campbell, APLC website, or the information contained within the website, should be construed as ATTORNEY ADVERTISING.

How to Resolve Your Private Student Loans

Step 1: Break Free from the Payment Treadmill to Nowhere!

*View this Huffington Post article that quotes Greg Fitzgerald’s Top 10 Reasons You Should Stop Paying Your Unaffordable Private Student Loans.

If you haven't already, you should seriously consider defaulting on these loans. Although many factors are involved (such as the loan amount), it's essential to speak with an experienced student loan lawyer first.

We often recommend clients default on these loans when:

- You can’t afford to pay them.

- You have no idea when they will be paid off. Just as you wouldn't buy a car or a house without knowing when the payments would end, the same applies to private student loans.

Step 2: Understand Unsecured Debt

Understand that Private student loans are unsecured debt and are no different from your credit card (except for how they are treated in bankruptcy). Since bankruptcy is usually unavailable for these debts, strategic default is often the only way to get out of debt on most loans within your lifetime.

As with any unsecured debt, there are only three things they can do to you when you default on a private student loan:

- Call and write to you, demanding payment (having a lawyer as your representative will stop this)

- Derogatory report on your credit

- File a lawsuit against you - examine our case results, and you will find that the only thing worse than a lawsuit is continuing to pay the full amount and never seeing the balance go down. Also, not all clients get sued!

Step 3: Beware Student Loan Assistance Companies

Below is a list of well-known student loan assistance companies that have been accused of shady practices, as published by NerdWallet (read the original article here).

Several of the companies listed below have been charged with various business violations, including:

- Illegal practices by a state or federal agency or found to have engaged in illegal practices by a judge;

- Being managed by an individual who operates or has operated another business accused of illegal practices by a government agency or found to have engaged in illegal practices by a judge;

- Being operated by someone who has incurred significant debts or a criminal conviction;

- The business has been hit with liens for unpaid taxes or

- The business is Rated D or F by the Better Business Bureau.

If you’re working with one of the companies below, CALL US IMMEDIATELY! Let us help you manage your debt and GET YOUR LIFE BACK!!

STUDENT LOAN ASSISTANCE COMPANY WATCH LIST

A list of all companies on the watch list can be found here.

- Academic Debt Alliance

- Action Administrative Services

- Advantage Student Loan Consolidation

- Advantage Student Loans

- Affordable Life Plans

- Aiding Student Relief

- Allied Doc Prep

- AlphaOne Student

- Amazing Marketing

- American Student Aid

- American Student Loan Consolidators

- ASF Assistance

- Benchmark Processing Inc.

- Bright Futures Financial Corp.

- College Education Services

- College Financial Advisory

- Consumer Assistance Project

- Consumer Financial Resources

- Consumer Protection Counsel, P.A

- DFL International

- Docs Done For You Inc.

- Document Aid Relief

- Done With Loans

- Equitable Acceptance Corporation

- First American Student Aid

- First American Tax

- First American Tax Defense

- Freedom Student and Tax Defense

- Global Financial Support Inc.

- Good EBusiness

- Grads1st

- GreenStudent

- Help Assist Me Default Resolution Services

- Interactiv Education

- Lexington Doc Prep

- Liberty Tax and Student Loan Defense

- Life Cycle Student Loan Relief

- Merrill & Hart

- Miller Student Loan Consulting

- Nation Wide Consumer Debt Relief Inc.

- National Secure Processing

- National Student Aid Care

- National Student Aid Center

- National Student Loan Help

- National Student Loan Rescue

- National Student Loan Solutions

- National Student Loans

- Nationwide Student Aid

- Navloan

- Performance Debt Relief

- Performance Settlement

- Post Grad Aid

- Private School Loans Relief

- Reliant Account Management

- Select Document Preparation Inc.

- Select Student Loan

- Select Student Loan Help

- SL Programs

- SLRS

- Strategic Debt Solutions

- Strategic Doc Prep Solutions

- Strategic Student Solutions

- Student Advocates

- Student Consulting Group Inc.

- Student Debt Center

- Student Debt Relief Group

- Student Debt Resolutions Inc.

- Student Debt Solutions

- Student Financial Resource Center

- Student Legal Services

- Student Loan Consultants of America

- Student Loan Counsel

- Student Loan Educators

- Student Loan Forgiveness Center

- Student Loan Group

- Student Loan Managers

- Student Loan Processing.US

- Student Loan Repairman Inc.

- Student Loan Resolution Center

- Student Loan Service

- Student Loan Service Managers

- Student Loan Services

- Student Loan Servicing Center

- Student Loans Processing Corp.

- Student Reform Associates

- Student Relief Center

- Student Zoom LLC

- StudentLoan911.org

- Sunshine Document Preparation Inc.

- The Center for Student Debt Reform

- The Student Loan Help Center

- The Student Loan Project

- U.S. Student Loan Services Inc.

- United Advisors Group

- United Student Loan Division

- University of One

- US Direct Student Loan Services

- US Financial Freedom Center

Real Client Results

Conquering Your Mountain of Debt Since 1992

-

$1,043,087.06 settled for $492,701.56 Individual

-

Client Saved $27,433.00! UGH, I LLC.

-

$535,175.56 was settled for $375,000.00 Madison 65 Co

-

Client’s debt was reduced by $314,811.00! National Continental Insurance Company

-

$263,963.17 JUDGMENT VACATED! Los Angeles County Superior Court

Hear From Our Happy Clients

At Fitzgerald & Campbell, your satisfaction is our priority! See for yourself what our clients have to say about working with us.

-

"Great help from the start!"Fitzgerald & Campbell were a great help from the start. Seeking their legal help for dealing with debt collectors was the right decision. The process was simple and straightforward, reducing my stress greatly for a reasonable price. Highly recommend!- C.M.

-

"Clarity and prompt communication."We were involved in a tricky sister-state judgment case from a vehicle accident in Nevada. Several attorneys were stumped, but Fitzgerald & Campbell provided clarity and prompt communication to vacate the judgment. The case is now dismissed without prejudice. Highly recommended.- E.C.

-

"Fitzgerald & Campbell is Truly Praiseworthy"

I was in a difficult and stressful situation. I was sued and served over an old personal loan.

Fitzgerald & Campbell helped me to settle and lowered the judgment amount in less than a month.

This firm is outstanding and they care about their clients.

Thank you, Ms. Patricia Mendez for being so passionate and so helpful about my case.

Now, am stress free.

Fitzgerald & Campbell is a truly praiseworthy and highly recommended firm.

Thank you.- E.A. -

"You Are All Amazing"

Thank you very much, Ma'am for the immediate help.

You are all amazing!🙏🙏🙏

- E.A. -

"Friendly hand to get you out."Dealing with a judgment and wage garnishment, Fitzgerald & Campbell explained my options to settle and guided me through the paperwork. They handled all communication with the creditor, negotiating a settlement I could afford. They extend a friendly hand to get you back on your feet.- S.J.

Contact Our California Student Loan Debt Lawyer Today

When seeking an experienced California student loan debt lawyer, consider consulting with Fitzgerald & Campbell. We provide you with the legal expertise to take appropriate steps to default on your loans or pursue other viable solutions. Student loans can impose immense pressure on individuals, and our team of student loan attorneys is dedicated to assisting you.

FIND OUT INSTANTLY THE ANSWER TO THE 3 MOST FREQUENTLY ASKED QUESTIONS ABOUT DEBT SETTLEMENT:

- How much Money is needed for a Successful Debt Settlement Plan? In total? Per month?

- How Long does a Debt Settlement Plan take?

- How much Can I Really Save?

Contact Fitzgerald & Campbell, APLC, today to schedule a FREE consultation!