Although the US economy has continued to pick itself back up throughout 2021 and the threat of coronavirus has seemingly begun to diminish due to the availability and increasing acceptance of vaccines, many individuals are still struggling to get back on their feet. After such a difficult time, it is not unusual for it to years to get back to normal—and even worse, dealing with sickness like the coronavirus could have long-term effects.

As murmurings of a potentially dangerous virus began circulating in the beginning of 2020, few could have imagined how quickly the world would change, and how badly the US would be affected. Unemployment affected tens of millions of workers who were suddenly left without health insurance or left to deal with an unexpected lapse in coverage which surely could not have happened at a worse time in life—or history.

Credit card usage for expenditures like eating out and shopping retail may have begun to decline at a surprising rate during COVID, others were unfortunately forced to run accounts up to the max as an alternative form of income. Available credit card balances may have been used for paying basic bills like utilities, or basic expenses like groceries—in the face of absolutely no income.

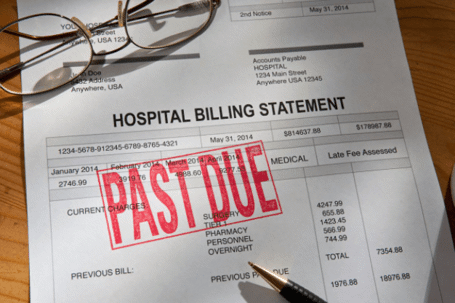

Medical debt and credit card debt can also be an unfortunate pairing, and especially for the challenges encountered with COVID. With the ability to charge up medical bills like doctor’s visits and co-pays, prescriptions, and even pay for procedures, credit card debt can quickly spiral out of control for consumers.

If you are worried about your mounting medical debt, contact an experienced credit card debt attorney from Fitzgerald & Campbell, APLC as soon as possible to explore your options. This is even more urgent if you have been served with a summons and complaint either from a private process server or a deputy. While you may wonder what the point is in taking any such legal action seriously when you have nothing much left to give, or take, consider the fact that a default judgment can last 20 years in California, meaning that a creditor or debt collection agency can chase you for that long too in attempting to see debts satisfied.

Speak with an attorney from Fitzgerald & Campbell, APLC to examine your options. Our attorneys have decades of experience in serving clients as they navigate through challenging financial situations, including student loan issues, bankruptcy, and other debt management processes. We are here to help! Click here to schedule a free 30-minute consultation, call us at (844) 431-3851, or email us at info@debtorprotectors.com.