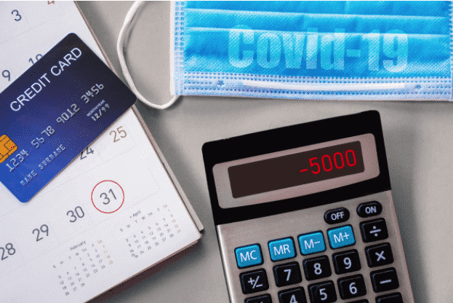

Debt hovered over most Americans previous to COVID, and little has changed as the era of the viral pandemic begins to diminish, except that millions are now dealing with the long-term financial repercussions of unemployment and of course, serious health problems after COVID or in helping dependents through illness and recovery.

As job losses escalated and restrictions ensued in the US, typical American spending involving credit cards began to decline; after all, there simply were not as many opportunities to eat out, go to movies, travel by plane to vacation spots, or go shopping for retail items. Credit cards suddenly became the best way to survive for those quickly running out of options in the face terribly unexpected loss due to sickness, financial issues, and more.

Recent data shows Americans hold around 506 million credit card accounts, owing $807 billion, with larger households carrying, not surprisingly, larger amounts of credit card debt.

“People with college degrees carry higher credit card balances, even though only 43% carry credit card debt, compared with 52% who have some college and 47% who ended their education after high school,” stated information from Value Penguin.

These numbers may change drastically once all the data has been collected from the ‘time of COVID,’ and for many, it could take years to recover after months of sickness, lack of health insurance and no work, and mounting debt. While buying the basics and paying essential bills to stay afloat may account for large and sudden credit card balances, medical bills are a enormous concern for millions now.

If your credit card debt is spiraling out of control, speak with an attorney from Fitzgerald & Campbell, APLC as soon as possible. This is even more critical if you have been served with a summons and complaint and are dealing with one or more collection lawsuits. It’s common to feel overwhelmed, embarrassed, and normal to want to just push everything under the rug—and especially if you feel like you have nothing left to lose; however, don’t let the situation get worse with a default judgment.

Without any attention to the matter, a judge could grant a default judgment almost automatically, leaving you to deal with wage garnishments, seizure of property to be sold at public auction, and loss of control over financial accounts until debts are satisfied. While it may be little consolation to hear the old saying that ‘you are not alone,’ that simply couldn’t be more true after all the pain and suffering endured since 2020. Strangely, this is also one of the best times to communicate with creditors and debt collection agencies and even negotiate better terms on interest and payments or discuss the opportunity to pay off debts in one lump sum at a heavily discounted rate.

Speak with an attorney from Fitzgerald & Campbell, APLC as soon as possible to examine your options. Our attorneys have decades of experience in serving clients as they navigate through challenging financial situations, to include student loan issues, bankruptcy, and other debt management processes. We are here to help! Click here to schedule a free 30-minute consultation, call us at (844) 431-3851, or email us at info@debtorprotectors.com.