An 8-part case study of an actual FITZGERALD & CAMPBELL, APLC client who did

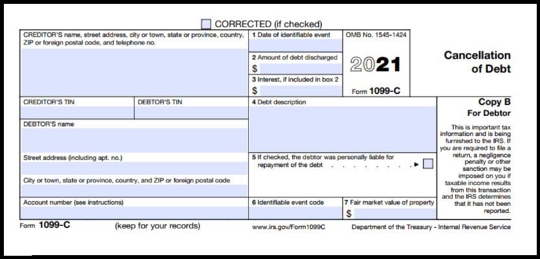

Part Three - What About The Tax Consequences And The Dreaded 1099-C?

Another great question John had was the 1099-C issue. If the debt is settled for less, isn’t the amount that is cancelled taxable? The short answer is it could be. The creditor could issue a 1099-C for the amount of the debt that is not paid (cancelled). That goes to the IRS and if you get one, you need to make sure your tax professional is aware of it. It will depend on your overall tax picture if you have any additional tax liability because of it. For example, Form 982 may apply to you. Also, if you do have costs (such as lawyer fees) to get the reduction, these can be used to offset the “income” from debt cancellation.

But let’s look at the “worst case” scenario: John gets a 1099-C for the eventual $80k he “saved”, and he must pay tax on it. First, he had expenses for that “income”: legal fees. This amount should be used to offset the “income” from debt cancellation. In John’s case that was roughly $11K, leaving “income” of $69k. Even at a tax rate of 30% that would be approximately $20K of tax. It would be foolish to not accept a $20K settlement. $20K to the creditor plus $20k in taxes and $11K to the lawyer is still a lot less than $98k plus interest that is made in payments over many years such that the total outlay is literally hundreds of thousands of dollars over many years.

John saw the math. $51K total out of pocket (worst case) was still far better than $98k plus interest on a 20-year payment plan. And his credit would be far better with $0 debt. And he would be able to save for a house much faster. Even with the possible taxes for debt cancellation. No brainer.

For more on the 1099-C issue, see Fitzgerald’s extensive article: The King of Zombie DEBT, the 1099-C

Click here for: Part Four – That All Sounds Good, But What Are The Fees?