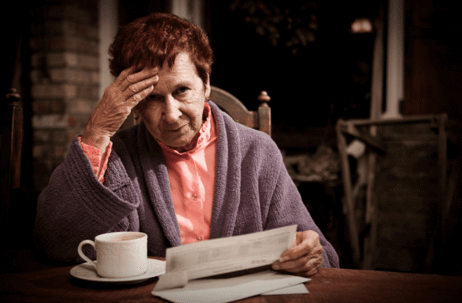

Debt can spiral out of control surprisingly fast—and devastatingly so. This is especially true now as so many dedicated and hardworking citizens have lost their jobs due to economic issues stemming from the COVID-19 pandemic.

Household debt, continually escalating to one historic high after another—quarter after quarter—was already in question at the very beginning of 2020, although lenders were still lending, and credit card users were not holding back either. Once shut-downs and quarantining began nationwide though, all bets were off, and tens of millions of individuals were seeking unemployment benefits. A temporary bandaid for many, as the months continued to unfold, debt sat there waiting of course, and for many it also just continued to grow.

If you were already experiencing financial duress due to an extended illness or injury requiring long-term recuperation, it could have been very easy to lose track of the debt load and looming disaster which may arise in the form of a collection lawsuit—or worse, the eventual default judgment.

Defendants often feel so intimidated by the whole court process and the idea of being sued that they just ignore a collections lawsuit altogether. Other times, they may have not actually received service of process, with a process server or deputy sheriff delivering the summons and complaint, and may be completely unaware of the case.

Although ignorance can be bliss sometimes, without knowledge of legal action being taken, serious repercussions could occur, and they undoubtedly would be noticed later—especially after a default judgment was granted. This commonly happens as a consumer goes to use a debit card and finds out that their account has been frozen (leading to real headaches). Wages may be garnished too in order to satisfy a debt, and in California this could be up to 25 percent of your disposable income! Even worse, law enforcement can also seize personal property and sell it at public auction.

Speak with an attorney from Fitzgerald & Campbell, APLC as soon as possible to examine your options. Our attorneys have decades of experience in serving clients as they navigate through challenging financial situations, to include student loan issues, bankruptcy, and other debt management processes. We are here to help! Click here to schedule a free 30-minute consultation, call us at (844) 431-3851, or email us at info@debtorprotectors.com.