Today, the average household in the US carries over $8000 in credit card debt, with the average consumer and credit card holder possessing at least four pieces of plastic. As consumer and household debt reaches historic highs, nearly 200 million Americans are being tempted to spend on credit cards—or are living in misery trying to pay off high balances. This may only be the tip of the iceberg too as they suffer through a continued litany of demands via phone calls and letters from creditors demanding payments for debts they expect to be satisfied.

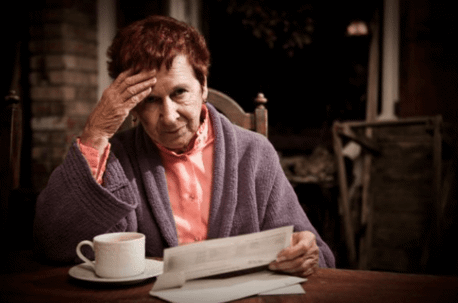

You may be extremely worried about your financial health. Greater debt across the US can bolster the economy for a while but on the individual level you may find yourself working harder than ever to keep up with the rising cost of living—and while this may be modest in some geographical areas, it can be terrifying in others.

While you may be fretting over declining financial health, such worries and ongoing repercussions from debt may be taking an even more concerning toll on your emotional and physical health; in fact, you could find yourself developing—or exacerbating—life-threatening complications like heart issues. Coupled with more medical bills, debt and physical and emotional issues can create a vicious cycle. If you find yourself embroiled in this type of scenario, consult with an experienced debt protection attorney from a firm like Fitzgerald & Campbell, APLC as soon as possible.

Depression and anxiety over debt may be increased tenfold if you find yourself in the middle of a collection lawsuit; however, this may be just the impetus you need to act swiftly and rid yourself of stressful debt forever. While filing for bankruptcy is an option, in working with your attorney you may find yourself realizing that not only is it critical to answer the lawsuit and be an active participant in dealing with debt, but also that a surprisingly simple defense on your part may cause a debt collections agency to back down quickly. No matter how you can resolve your money problems, taking control and paving a new path to financial freedom is key to leading a fruitful life.

Speak with an attorney from Fitzgerald & Campbell, APLC as soon as possible to examine your options. Our attorneys have decades of experience in serving clients as they navigate through challenging financial situations, to include student loan issues, bankruptcy, and other debt management processes. We are here to help! Click here to schedule a free 30-minute consultation, call us at (844) 431-3851, or email us at info@debtorprotectors.com.