People fall into debt for so many different reasons today in the United States, sometimes resulting in the burden of default judgment. There are typical issues with overspending and the affinity for retail therapy (which is often even encouraged), the common desire to look impressive and keep up with everyone else—and in some cases, just outright money mismanagement that leads to ruin and the need to file for bankruptcy.

You may be struggling to keep up with huge student loan debt payments, and if you have a family, support their needs too; in fact, many households today consist of two partners who are carrying substantial debts to be satisfied to student loan servicers. This can be incredibly stressful, on top of the anxiety now produced by the coronavirus pandemic and the loss of so many jobs for so many, not to mention the ravaging of illness around the nation, loss of friends and family, and of course, extreme restrictions on travel and the ability to leave the home.

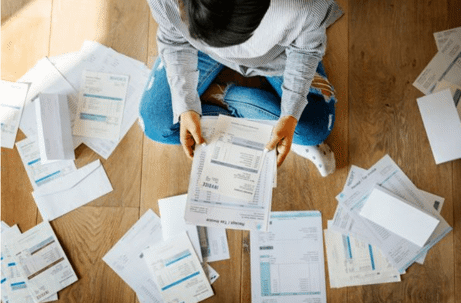

Finances—and debt—are an even bigger topic than usual. If you are under duress and creditors are calling you, the bills are piling up, and the whole situation is beginning to feel hopeless, there may be enormous temptation just to “let it all go.” This is generally not the recommended course of action for anyone, but if you don’t have a job or money, or possessions for creditors to take, you may wonder why you should bother. If you have a collection lawsuit pending, it could be a while before you go to court—but this is the time to file a reply and launch a defense; however if you feel there is nothing to lose, you may be considering not making a move at all.

The key item to consider is whether there truly will not ever be anything to lose. If you do not reply to a collection lawsuit and lose by default, the court judgment that is filed against you (and almost automatically) is good for ten years.

Consider whether you can go for ten years without a job (where wages could be garnished due to the judgment), without opening a checking account (that could be levied), or without owning any possessions (that could be seized). Then, consider whether you could go another ten years, as default judgments are easily extended another ten years after the first time. Good legal advice could be critical to your future, along with helping you to answer the collection lawsuit and launch a defense in court.

Speak with an attorney from Fitzgerald & Campbell, APLC as soon as possible to examine your options. Our attorneys have decades of experience in serving clients as they navigate through challenging financial situations, to include student loan issues, bankruptcy, and other debt management processes. We are here to help! Click here to schedule a free 30-minute consultation, call us at (844) 431-3851, or email us at info@debtorprotectors.com.